Flex Spending Account Max 2025. Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are higher than they were last year. What is a flexible spending account?

Max health care fsa contribution (per person/employee) dependent care fsa max election (married, family max) dependent care fsa max election (filing. Here, a primer on how.

The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025.

Flex Spending Account? Use it! Don't Lose it! Visit Weaverville, As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum. In 2025, that limit will be $3,200, up from.

Flex Spending Reminder Clipart, The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025. For 2025, there is a $150 increase to the contribution limit for these accounts.

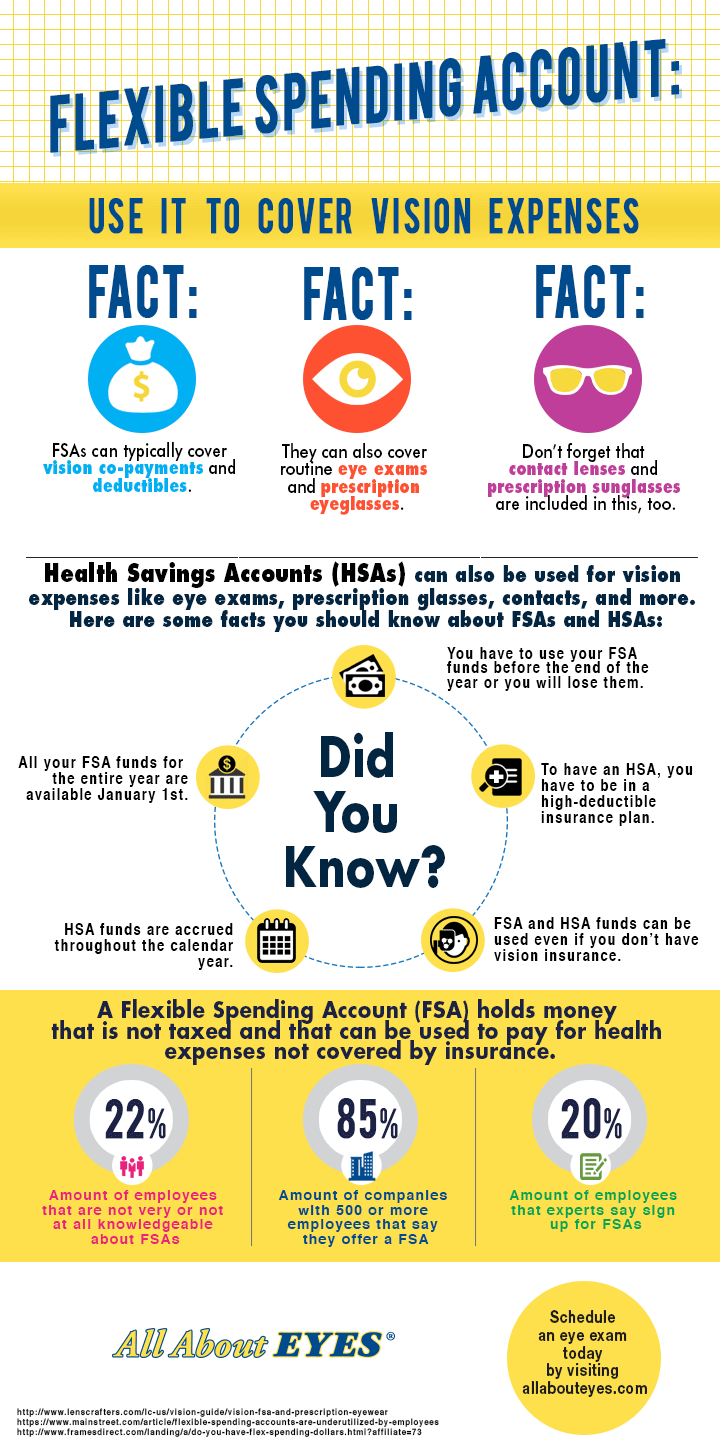

Have a Flex Spending Account? Here Are 50+ Surprising Things It May Pay, Amounts contributed are not subject to. The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025.

FSA (Flexible Spending Account) Use it or Lose it Val Vista Vision, Max health care fsa contribution (per person/employee) dependent care fsa max election (married, family max) dependent care fsa max election (filing. The most money in 2025 that you can stash inside of a dependent care fsa is $5,000, or $2,500 if married and filing separately.

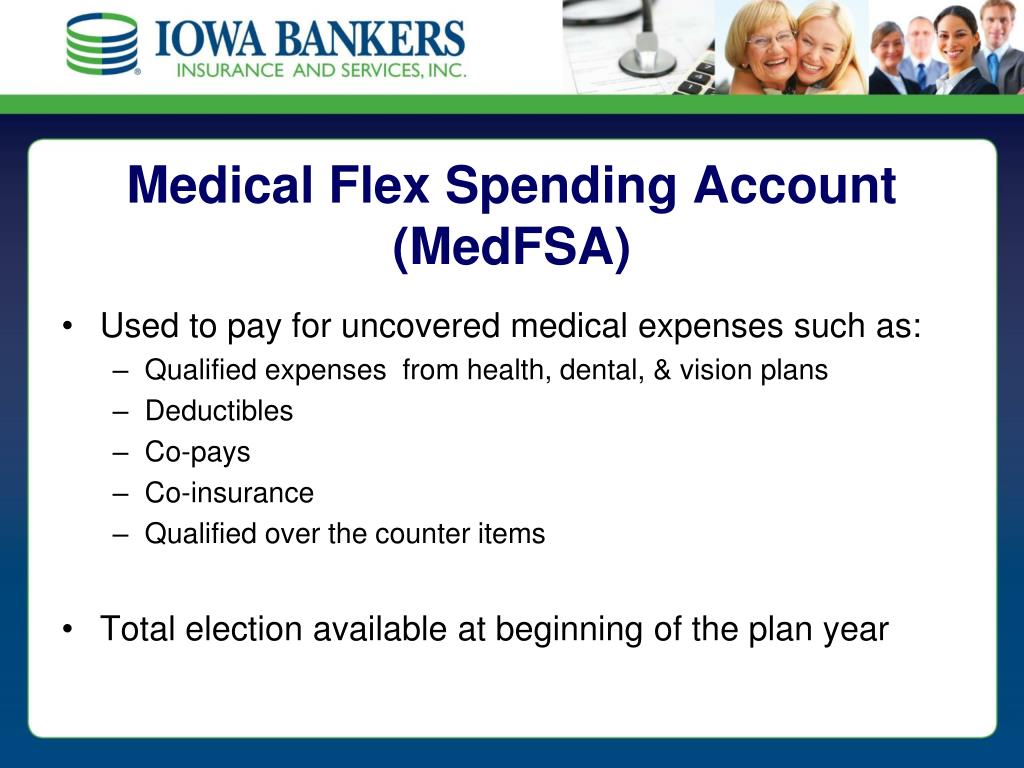

What Can I Buy With A Flex Spending Account Buy Walls, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense.

Flexible Spending Account Use It or Lose It! PEO Broker, Houston, Get the answers to all your fsa questions. $3,050 health fsa carryover limit:

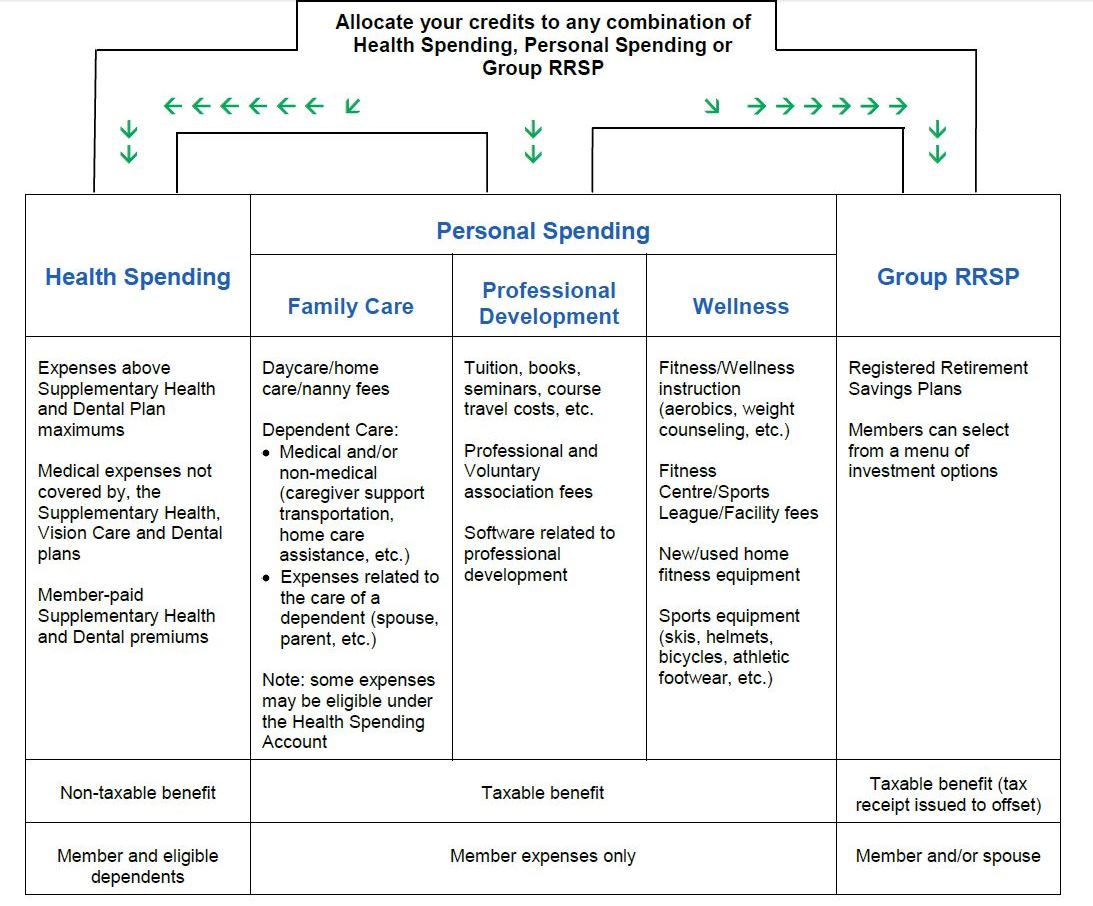

Benefits Professional Association of Resident Physicians of Alberta, $3,050 health fsa carryover limit: Employees in 2025 can contribute up to $3,050 to their health care flexible spending accounts (fsas), pretax, through payroll deduction—a $200 increase from.

PPT The IBIS 125 Advantage Plan PowerPoint Presentation ID172531, $610 dependent care flexible spending accounts ± The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025.

Using the Money in Your Flex Spending Account (FSA), The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. 2025 fsa maximum carryover amount:

Can I Use My Flexible Spending Account for Designer Frames? Holiday, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense. You can use the money in your fsa to pay for many healthcare expenses that you incur, such as insurance deductibles, medical devices, certain prescription drugs,.

You can use the money in your fsa to pay for many healthcare expenses that you incur, such as insurance deductibles, medical devices, certain prescription drugs,.

Employees in 2025 can contribute up to $3,050 to their health care flexible spending accounts (fsas), pretax, through payroll deduction—a $200 increase from.